33+ refinance mortgage tax deduction

Compare Refinance Rates Lenders To Find The Perfect Mortgage For You. The standard deduction is 19400 for those filing as head.

Are Mortgage Payments Tax Deductible Taxact Blog

Put Your Equity To Work.

. Web These costs are usually deductible in the year that you purchase the home. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Rent you receive from tenants is taxable income and.

One week ago the 15-year fixed-rate. Taxes Can Be Complex. Web As of 2022 taxpayers can claim the following standard deductions.

But if not you can deduct them pro rata over the repayment period. Web The average interest rate on the 15-year fixed refinance mortgage decreased to 633. Check Out Our Rates Comparison Chart Before You Decide.

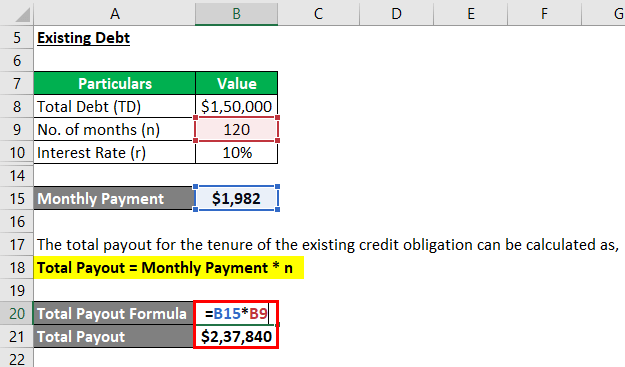

Yesterday it was 634. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The rules are different when youre refinancing the mortgage on a property you use to generate rental income.

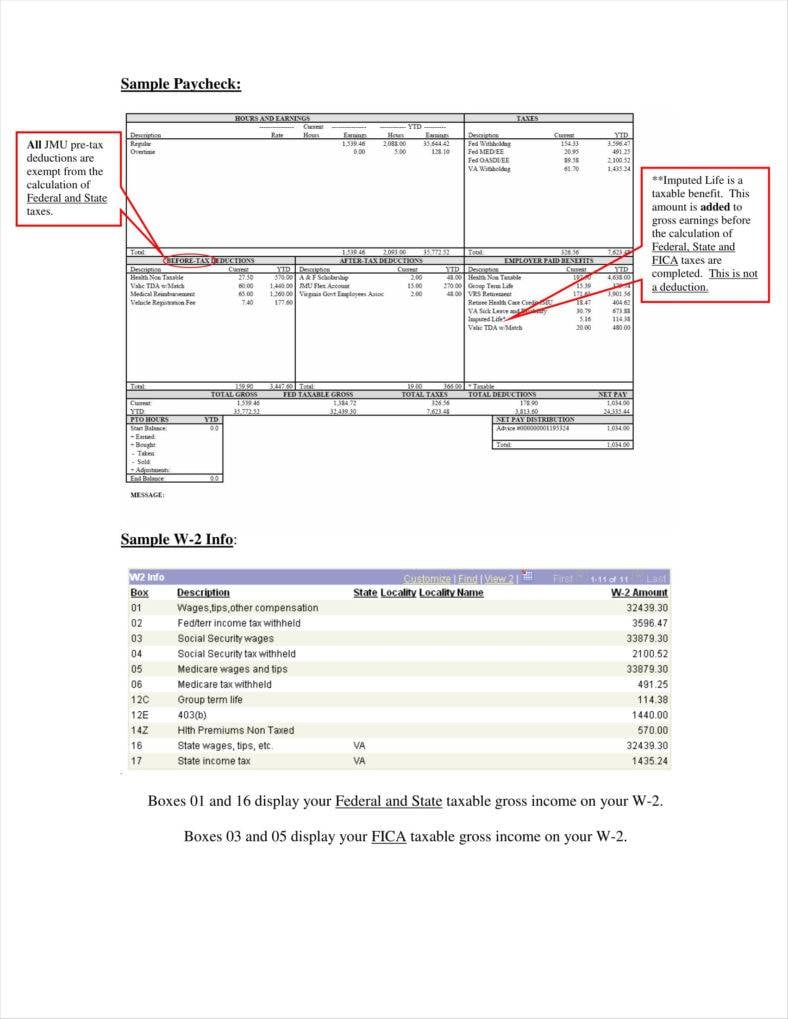

Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large. Dont Wait For A Stimulus From Congress Refinance Instead. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Single or married filing separately 12550 Married filing jointly or qualifying widow er. Web If you take the standard deduction which most filers do then your mortgage refinance wont affect your taxes one way or another.

Web home mortgage deduction mortgage interest deduction limit refinance refinancing mortgage tax deductions limits mortgage interest deduction refinance changes. Web Generally the same tax deductions are available when youre refinancing a mortgage as when youre taking out a new mortgage to buy a home. Web For 2021 tax returns the government has raised the standard deduction to.

12950 for single taxpayers. Only 31 of US. Web Are refinancing costs tax-deductible.

Certain refinancing and mortgage costs are deductible. Ad Looking For a Loan Refinance. 25900 for married taxpayers filing jointly up from 25100 in 2021.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Essentially this new mortgage is treated as a brand-new loan and is subject to the new limits with only the acquisition portion eligible for the tax deduction. Homeowners who bought houses before.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web So if you purchase 2000 worth of mortgage points on a 15-year refinance for instance you can deduct about 13333 per year for the duration of the loan. For example if you.

Nerdwallet Reviewed Refinance Lenders To Help You Find The Right One For You.

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How Does Refinancing Affect My Taxes Movement Mortgage Blog

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Culpeper Times March 16th 2017 By Insidenova Issuu

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Betterment Resources Original Content By Financial Experts App

Betterment Resources Original Content By Financial Experts App

Steffan Clements Nmls 502185 Bellevue Wa

Home Mortgage Loan Interest Payments Points Deduction

84 Credit Repair Ideas Credit Repair Companies Credit Card Debt Payoff Credit Repair

Hard Money Page 15 Sun Pacific Mortgage Real Estate Hard Money Loans In California

What Tax Breaks Do Homeowners Get In New York

Refinancing How Does Refinancing Work With Example

What Is The Mortgage Interest Deduction And How Does It Work Thestreet

33 Stub Templates In Pdf